If you’re the parent of a teenager who is getting ready to climb behind the steering wheel, insuring your new driver can be an expensive endeavor. This is because the risk of motor vehicle crashes is higher among 16- to 19-year-olds than among any other age group. So we’ve gathered some helpful tips to help you keep your premiums as low as possible, and keep your teen safe and accident-free.

[hr_invisible]

Policy Options

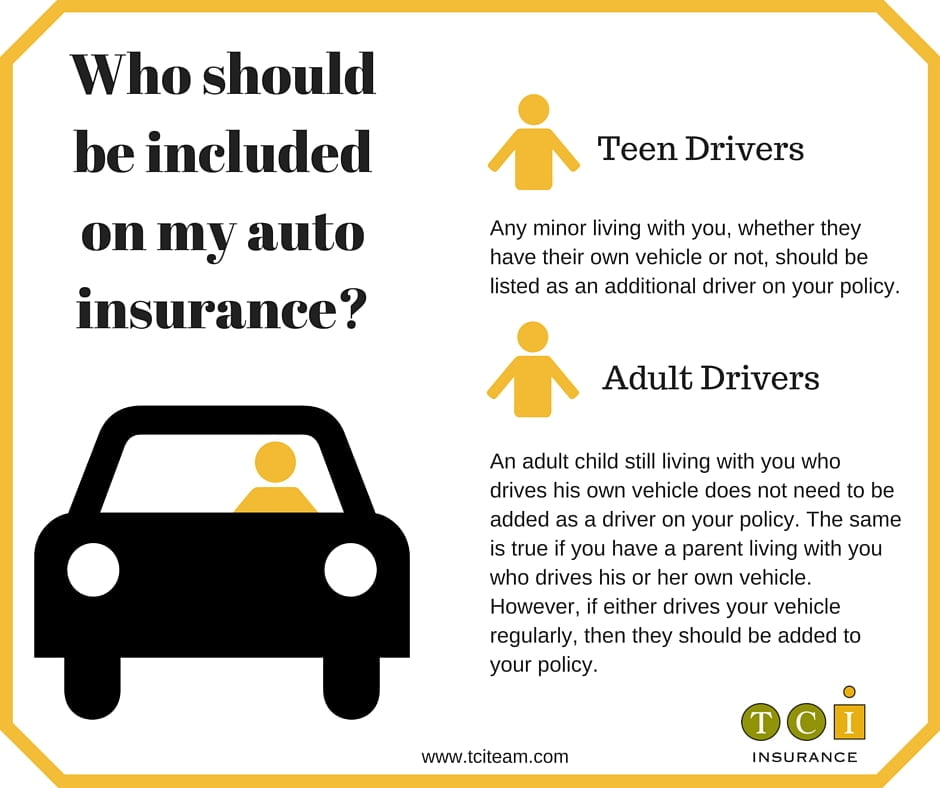

Typically, the most cost-effective option is going to be adding your teen as an additional driver on your auto insurance policy. If you have more than one vehicle, keep costs down by designating which vehicle your child will be driving. Keep in mind that the newer the car, the more expensive the coverage will be.

You may also want to look at your current deductibles. Auto deductibles typically range from $250 to $1,000. By upping your deductible and using your insurance for big repairs, you can significantly reduce your premium. If you lease or finance a car, the leasing or financing company may require a deductible cap of $500.

[hr_invisible]

Discounts

If your teenager maintains at least a 3.0 grade point average (GPA), he or she may qualify for a good student discount. We’ll need a copy of his or her grade report in order to request the discount. To help motivate your child, consider making driving privileges contingent on maintaining good grades.

Also, some companies provide a discount for drivers who complete a safe driving course. This is not the same as completing pre-licensing driver’s education courses. These classes are specifically designed to teach safe driving techniques and skills. We’ll need a copy of the course completion certificate in order to request the discount.

[hr_invisible]

Vehicles

Teenagers are among the riskiest drivers, but they often end up with inexpensive vehicles that don’t offer adequate protection in a crash. To help families find safer vehicles that fit within their budgets, the Insurance Institute for Highway Safety (IIHS) began publishing a list of recommended used vehicles for teens in 2014.

There are two tiers of recommended vehicles, best choices and good choices. Prices range from about $2,000 to nearly $20,000, so parents can buy the most safety for their money, whatever their budget.

The IIHS recommendations are guided by four main principles:

- Young drivers should stay away from high horsepower. More powerful engines can tempt them to test the limits.

- Bigger, heavier vehicles are safer. They protect better in a crash, and insurance data shows that teen drivers are less likely to crash them in the first place. There are no minicars or small cars on the recommended list, though small SUVs are included because their weight is similar to that of a midsize car.

- Electronic stability control (ESC) is a must. This feature, which helps a driver maintain control of the vehicle on curves and slippery roads, reduces risk on a level comparable to safety belts.

- Vehicles should have the best safety ratings possible.

[hr_invisible]

Set Your Expectation for Safety

The best way to keep your teen’s insurance premium stable is to ensure he or she maintains a clean driving record. To help reduce potential accidents:

- Restrict your teen’s nighttime driving

- Limit the number of passengers in the vehicle

- Ban cell phone use while driving even if your state’s laws are more lenient

- Establish driving-area limits

- Set a curfew

- Talk to your teenager about the dangers of drinking and driving

- Insist on seat belt use for everyone in the vehicle

- Ride with your son or daughter occasionally to make sure they are keeping up with the safety habits that they learned in driver’s education

While you can’t do anything about your teen’s young driver status, there are many things you can do to help them keep their good driver standing. Teens can get distracted easily, which increases their risk. To minimize their potential for distractions:

- Do not allow them to drive with more than one other person in the car for their first year.

- Ban the use of electronics, such as talking or texting on a cell phone or listening to music while behind the wheel.

Not only is restricting phone use a good idea, it may be the law. The use of cell phones by young drivers is prohibited in 28 states and the District of Columbia. Also, in many states, the law designates the number of passengers young drivers are allowed to have in their vehicle at one time. Make sure you – and your teen driver – know the regulations in your state, county and city.

If you have any additional questions about insuring your teen driver, contact us today!

[hr_invisible]

[hr]

Did you know?…

It is expensive to add a teen driver to an auto insurance policy due to inexperience, recklessness, and the fact that they are almost three times as likely to be in a fatal accident than all other age groups.

While the rates are still high, the average increase has been steadily declining due to teen driver safety as well as fewer teens behind the wheel. In fact, a recent study by the University of Michigan showed that 69% of 17-year-old Americans had a license 30 years ago while today it is 45%.

The 10 most expensive states to add a teen driver are:

| State | Premium Increase |

| New Hampshire | 125.39% |

| Rhode Island | 119.19% |

| Arizona | 109.36% |

| Wyoming | 105.77% |

| Ohio | 100.17% |

| Oregon | 99.87% |

| Maine | 99.13% |

| Connecticut | 96.33% |

| Vermont | 95.06% |

| Tennessee | 92.21% |

North Dakota ranks 34th with an average 77.55% premium increase to add a teen driver, while South Dakota is 45th with a 59.32% increase. Hawaii is the cheapest state to add a teen driver with an increase of only 16.93%.

Source: PIAND